Watchmakers build mechanical watches through a multistage process that includes design, parts fabrication, gear and escapement assembly, regulation, finishing, and casing. By understanding how mechanical watches are made, industry professionals can better interpret emerging trends and identify the innovations shaping the market in 2025.

Recent market research shows that the global mechanical watch market reached approximately USD 61.9 billion in 2024. Analysts project continued growth into 2025, driven by renewed interest in heritage craftsmanship and the expanding luxury segment (Source: Global Market Insights).

In 2025, the industry’s evolution centers on three major directions: technological and design innovation, manufacturing and supply-chain optimization, and shifting consumer preferences. Together, these forces reflect both changing consumer expectations and the expanding technical capabilities of watch brands.

Key Technological and Design Innovations in 2025

Ultra-Thin, Compact, and Skeleton Engineering

Brands continue to push the limits of thinness. Ultra-thin movements demand extreme precision in component thickness, tighter tolerances, and redesigned bridges and main plates. Engineers now reduce movement height without compromising stability or reliability.

Skeletonized and openworked movements also attract growing interest. Collectors increasingly prefer to see wheels, escapements, and balance assemblies in motion. Many boutique brands now offer skeleton versions of existing calibers, carefully balancing visual openness with structural strength.

Several Swiss manufacturers have re-engineered automatic rotor mounts to sit flush or partially recessed within the movement. This approach allows brands to reduce overall case height by 0.5–1 mm while maintaining power reserve and avoiding rotor interference (Source: Watches and Wonders 2025).

Advanced Materials, Coatings, and Protection Systems

Material science drives much of today’s innovation. Watchmakers now use non-magnetic alloys and silicon components for balance springs and escape wheels to reduce magnetic interference. Brands also apply DLC, PVD, and ceramic coatings beyond the case—such as on rotors and bridges—to increase wear resistance and reduce friction.

Manufacturers actively improve shock protection by refining jewel settings, balance staff designs, and micro-damping systems. As daily environments expose watches to stronger magnetic fields, brands increasingly integrate anti-magnetic cases and internal shielding to protect timekeeping performance.

Hybrid Precision Engineering and High-Performance Tuning

An emerging trend combines traditional mechanical architecture with advanced regulation techniques. Brands enhance mechanical movements through temperature compensation, refined calibration, and, in limited cases, auxiliary electronic support used strictly for precision adjustment rather than smart functionality.

At the same time, manufacturers emphasize high-beat movements operating at 36,000 vph or higher. Higher frequencies improve timekeeping stability under shock and motion, although they require improved lubrication strategies and careful wear management. Brands respond by optimizing escapement geometry, refining hairspring profiles, and adopting advanced lubricants.

Manufacturing and Supply Chain Enhancements

Localization and Vertical Integration

Many brands now prioritize regional production. Smaller and independent watchmakers increasingly develop movement components in-house or through nearby suppliers. This strategy improves quality control, reduces logistics delays, and strengthens supply-chain resilience.

For example, several European and Nordic brands now produce 70–80% of their movement components locally. They also highlight local manufacturing as a brand value, appealing to customers who value transparency and origin authenticity (Source: Financial Times).

Automation, Quality Control, and Digital Testing

Manufacturers rely more heavily on automated CNC machining, laser cutting, and digital metrology. Advanced inspection systems now verify tolerances at the micron level using machine vision and 3D scanning.

Instead of relying solely on final inspections, brands now implement quality control throughout production. Engineers define tolerance standards for individual components—such as gear trains, escape wheels, and balance assemblies—before final movement assembly.

Sustainable Materials and Efficient Production

Sustainability increasingly shapes production decisions. Brands adopt recycled metals, safer coatings, and energy-efficient manufacturing processes. Many also work to reduce finishing waste and scrap rates while requiring suppliers to meet environmental and sustainability certifications.

Market and Consumer Trends Driving Change

Collector Preferences and Aesthetic Revival

Collectors place greater emphasis on aesthetics and craftsmanship. Skeleton dials, exhibition casebacks, vintage-inspired details, and slimmer bezels continue to gain popularity. Demand for smaller and unisex case sizes also grows, especially among female collectors.

Brands now carefully balance decorative finishing—such as polished bevels and visible screws—with performance and durability.

Rising Expectations for Accuracy and Performance

Modern consumers expect more than acceptable accuracy. They demand consistency, reduced positional variance, and improved resistance to magnetism and shock. In response, brands tighten regulation standards, adopt higher-beat movements, and strengthen protective systems, turning performance into a key selling point.

Luxury Growth and Competitive Pressure

The luxury mechanical watch segment continues to expand, intensifying competition. To differentiate themselves from smartwatches and fashion watches, brands introduce limited editions, heritage-inspired collections, advanced materials, and distinctive complications. At the same time, rising material and labor costs force brands to carefully balance innovation and margins.

Implications for Watchmakers and OEMs

Modular Movement Architecture

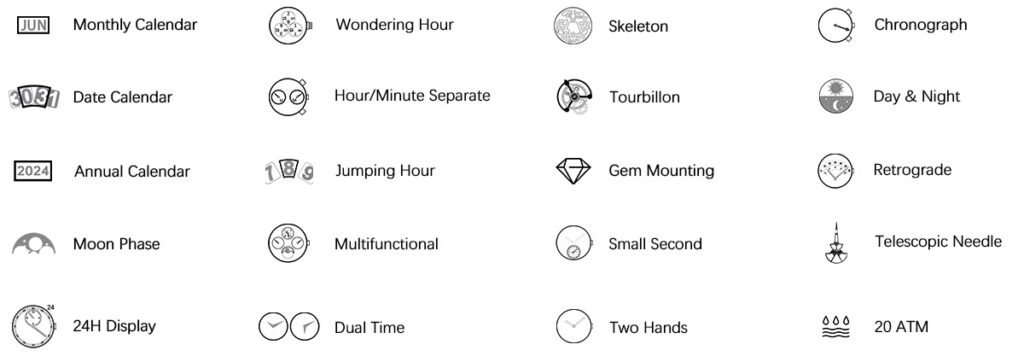

OEMs increasingly benefit from modular movement designs. Interchangeable modules for complications such as GMT, moonphase, or power reserve simplify customization and servicing. Modular architecture also lowers long-term support costs and improves repairability.

Balancing Innovation, Cost, and Brand Identity

Advanced materials and precision manufacturing raise production costs. Brands must integrate innovation without alienating core customers who value traditional aesthetics or accessible pricing. Strategic selection of features—such as skeleton finishing or high-beat movements—helps preserve brand identity while adding value.

Strategic Roadmaps and Market Positioning

Brands that follow a clear innovation roadmap gain long-term advantages. Gradual adoption of new materials, localized production, improved accuracy standards, and sustainability initiatives allows brands to adapt without disruption. Strategic messaging—such as “anti-magnetic,” “heritage skeleton,” or “sustainably manufactured”—helps connect products with evolving consumer values.

Conclusion: Mechanical Watchmaking in 2025 and Beyond

The way watchmakers create mechanical watches continues to evolve. In 2025, innovation reshapes materials, movement architecture, manufacturing precision, and consumer expectations. These changes directly influence pricing, positioning, and feature priorities.

For brands and OEMs, success depends on investing in sustainable sourcing, advanced materials, precision engineering, and compelling storytelling. For consumers, mechanical watches increasingly represent craftsmanship, accuracy, longevity, and transparency in an era defined by rapid technological change.